In my earlier posts, I spoke to the fact that many Canadians lack knowledge when it comes to their finances resulting in financial stress.

If you are part of that statistic, the below are some tips to help yourself climb out of debt and live a financially independent lifestyle.

1. Proper Mindset

Only you can control your financial future. It is important that you are committed to achieving financial independence.

You need to define what financial independence means to you. How much do you really need? This may involve meeting with a financial advisor or planner to figure out, but is an important exercise to determine your goals. Once you know what it means, use this to guide you in setting goals to achieve your financial independence.

Don’t be afraid of change. It is imperative to change your behaviours in order to achieve your goals and positively impact your success. You will need to be realistic; start off by choosing reasonable milestones and celebrate your successes. For example, if your goal is to save 20% of your income, start with a smaller percentage (e.g. 5%) and increase this rate as you get adjusted to your new budget and lifestyle.

Commitment is instrumental in the journey. A proper mindset involves commitment to review your goals (monthly at a minimum), to keep you focused and on track. Simply writing down goals is not enough, said better by Antoine de Saint Exupery, “A goal without a plan is just a wish”. Studies show that you are more likely to achieve your goals if you frequently review them.

2. Get Out Of Debt

Once you have established the proper mindset, it is important that you have a goal of getting out of debt as soon as possible.

Start by including debt repayment in your goals and budget. Set a realistic timeline for repayment, and stick to the repayment plan. Meet with a financial advisor or planner if you need assistance.

Getting out of debt may involve sacrifices in your spending habits. You may need to cut out that daily indulgence, or rethink that lavish vacation.

Commitment is needed, and will pay off once you are financially free. If you need motivation, post pictures of what financial independence looks like to you, or write out your vision of it and review it regularly as a reminder.

3. Start Saving Money

Rule #1 from The Richest Man in Babylon is “A part of yours is yours to keep”, which translates to saving a part of your income through paying yourself first.

If you think this is unrealistic, then you need to evaluate your budget and spending habits and find ways to lower your expenses. I recommend setting up a budget that includes savings goals. Monitoring your progress will help you stay on track.

If you make it a point to save before you start spending (pay yourself first), it will eventually become a habit. The sooner you start saving, the sooner you will achieve financial independence.

4. Control Your Expenses

I track my expenses to get a clear picture of my spending habits. This is used to determine if an area needs to be cut, and also helps me evaluate my needs versus my wants.

You may not have realized that you go out for a lot of expensive meals, or that shopping habit was costing you several thousands’ of dollars per year.

Take a closer look at your expenses and evaluate what is important to you. You may discover that expenses you thought were necessities are actually just nice to haves. Work on cutting out the nice to haves until your debt is paid off and you have started a savings plan. There may be several opportunities to cut spending once you have a clearer picture of your spending habits.

5. Start Investing

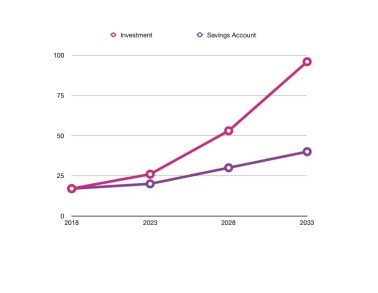

Once you have established a savings plan and reduced or eliminated your debt, it is time for you to start thinking about investing your additional savings. Interest rates are low, so earning that 0.25 or 1% return on your savings account is not going to fast track your savings.

Put your money to work by investing with the mindset of creating continuous income. Some examples include investing in exchange traded funds, stocks, or purchasing a rental property.

Overall, you need your investment portfolio to grow, as the larger your investment portfolio, the closer you get to financial independence.

Before investing, figure out your tolerance for risk and invest within it. Be smart and invest wisely.

Freedom Awaits You

The objective here is to develop the habits and behaviours to save first and spend later. Financial independence isn’t something that can be achieved overnight. Like most things in life, it takes effort and dedication to execute the above steps.

As said by author and motivational speaker Simon Sinek “Dream Big. Start Small. But most of all, start.” Most of all, start. This is such a simple phrase, yet it is so powerful. If we apply this to our goals, do they not appear less scary?

Start taking control of your financial situation and achieve the financial independence you deserve!

~ EverSavvy Financial

Recent Comments