These are some of EverSavvy Financial’s most-asked client questions. FAQs are updated frequently to ensure the most up-to-date information. If you do not see an answer here, please contact me directly.

1. How do we share documents with each other?

At EverSavvy Financial, we use Citrix Sharefile for sharing files with our clients. ShareFile is a secure content collaboration, file sharing and sync software. You can learn more about ShareFile here.

Our unique URL is https://eversavvyfinancial.sharefile.com/

When you are onboarded with us, we will create a folder specific to you, which only you can access. All of your client information will be shared with you within that folder. We urge our clients to create a ShareFile account for easier access and visibility of files.

Please refer to FAQ 2 below for information on how to create a ShareFile Account.

2. How do I create a Sharefile Account?

Here’s a step by step video to help you with setting up your Sharefile account.

Click on the unique URL above, or click here: https://eversavvyfinancial.sharefile.com/ to set up your account.

3. How do I pay the CRA?

For GST/HST or corporate income taxes, if you cannot pay via your online banking (my payment), or if you do not have a remittance voucher, then the most cost effective option is to pay via pre-authorized debit. To do so, you need to have a CRA my business account.

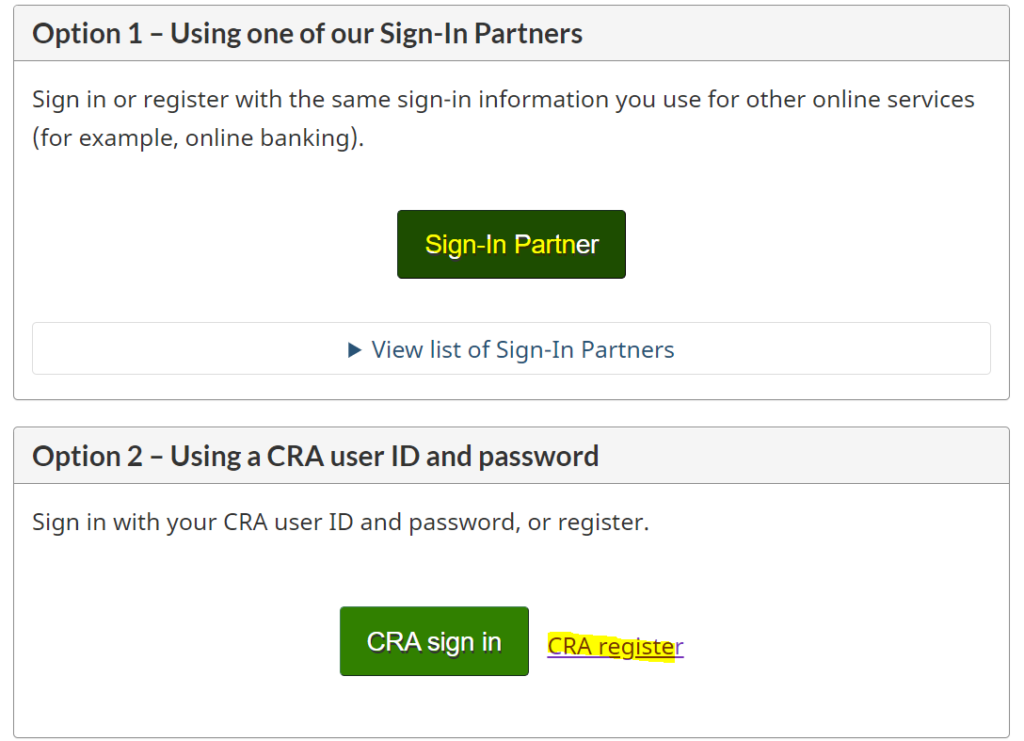

This is different from your personal account with the CRA (for your personal income taxes). If you have a GST/HST account, or a corporate tax account, you would need a CRA My Business account to make pre-authorized debits. Using the link above, you would click on either Sign-In Partner or CRA Register to initiate the registration process. Please refer to the screenshots below on what the options look like.

4. What is a CRA Account and how do I get one?

CRA My Account is a secure portal that lets you view your personal income tax and benefit information and manage your tax affairs online. If you do not already have this set up, I encourage you to do so as it provides you with valuable information (your mail with the CRA, notices of assessment, RRSP contribution room, TFSA room, information on installments due, payments on account with the CRA, and *much* more).

Note: Before you can register, you must have filed your income tax and benefit return for the current tax year or the previous one. Go to this link and select how you wish to sign up (Option 1 is using one of the CRA’s sign in partners, and Option 2 is using your own login ID and password).

For a CRA My business account, refer to the bottom portion of FAQ 3 above.

5. I am self-employed – how do I pay my Canada Pension Plan (CPP)? Am I contributing to CPP?

Rest assured that if you have pensionable earnings, they will be taxed and paid for with your personal tax return.

In general, employees contribute 5.7% of wages (above $3,500 of salary to maximum earnings of $64,900 of salary) to a max of $3,499.80 in CPP, and your employer contributes an equal amount (2022 rates).

Self-employed individuals are on the hook for both the employee and employer amounts, which means you are contributing 11.4% of your net self-employment earnings between $3,500 and $64,900, up to a maximum of $6,999.60 (2022 rates).

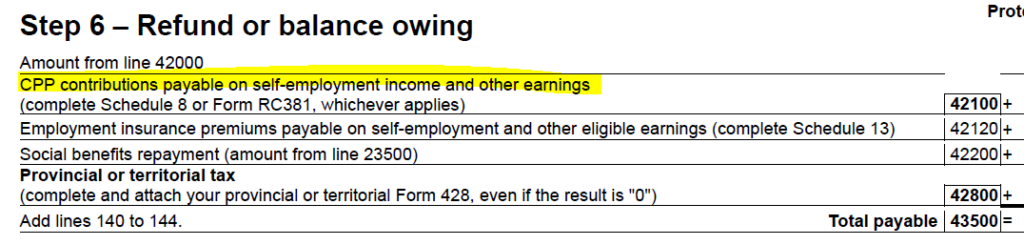

If you want to see exactly what you are contributing as a self employed individual you can refer to Schedule 8 (line 21) of your income tax return, or line 42100 of the refund or balance owing section of your T1 general (see snapshot below).

6. What is a T1 General and where can I get a copy of mine?

A T1 General is your personal income tax return. All copies of returns prepared by EverSavvy Financial are in your ShareFile folder, based on the year you are looking for. Visit ShareFile at https://eversavvyfinancial.sharefile.com/ (refer to FAQ 2 above if you have questions about your ShareFile account), click on the folder relating to the year you are in need of your T1 general for, and it is the file labelled LastnameFirstnameYear.pdf.

7. How do I add EverSavvy Financial as my CRA Business Representative?

Starting October 17, 2022, the Canada Revenue Agency (CRA) process for authorizing a new representative for business accounts will include an additional step. In the past, you would simply sign a form authorizing a represenative and access would be granted immediately. Now, there is an additional step where you need to activate the request within your CRA my business account.

To activate the request, you will need to:

- Sign in to your My Business Account.

- Go to the Authorized representatives section.

- Click on Confirm pending authorizations.

- Activate the authorization request sent from EverSavvy Financial

Please note that the CRA will cancel any request that is not activated within ten (10) business days. You can read more about this new process here.